Shulman Rogers Bankruptcy, Restructuring and Creditors’ Rights attorney, Michael Lichtenstein, was recently published in the September 2023 edition of Pratt’s Journal of Bankruptcy Law. He co-authored the article, When Can an Individual Close a Subchapter V Case After Plan Confirmation?, with Hope Gouterman.

Category: Publications

As Published in Pratt’s Journal of Bankruptcy Law: Bankruptcy Courts Inflict Pain on Mary Jane, as written by Michael Lichtenstein

“Bankruptcy Courts Inflict Pain on Mary Jane,” an article written by Michael Lichtenstein, Chair of Shulman Rogers’ Bankruptcy and Creditor’s Rights group, was published in the June 2023 issue of Pratt’s Journal of Bankruptcy Law.

Read the full article here.

Nancy Kuhn on Charitable Conservation Easements in Bloomberg Tax

Bloomberg Tax recently published an article written by Shulman Rogers’ Tax attorney, Nancy O. Kuhn in its January 2023 Tax Management – Estates, Gifts and Trusts Journal.

Nancy’s article, Destroying Charitable Conservation Easements Is Not Within Congressional Intent, updates the state of the law regarding the much-maligned charitable conservation easements. Recent developments are not in keeping with legislative intent to protect our environment. Instead, it is Nancy’s opinion that more attention should be paid to valuation of easements and whether the easement actually protects the environment. Instead, the Internal Revenue Service has focused on completely invalidating the easements and disallowing 100% of taxpayers’ charitable deductions due to legal technicalities. The IRS and most Federal courts are directly impeding the legislative purpose of section 170(h) and discouraging the protection of our environment.

Click here to read Nancy’s article. Reproduced with permission from Bloomberg Tax & Accounting. Published Jan. 12, 2023. Copyright 2023 by Bloomberg Industry Group, Inc. (800-372-1033) https://pro.bloombergtax.com/

What is a Convertible Note?

By NEXT Co-Chair Larry Bard and NEXT Associate Hunter Haines

“Debt or equity?” That is the question many early stage founders face when raising capital. While SAFEs[1] may be the instrument of choice for many early stage companies today, some investors still prefer a traditional convertible note. A convertible note is a debt instrument that needs to be repaid—typically through cash or shares of a company. Convertible notes are a way for seed investors to invest in a company, usually startups, that are not ready to place a valuation on the company. Or to define in lay terms, a convertible note is a type of debt that converts into equity when a startup reaches an agreed-upon milestone. This milestone is usually the company’s next equity financing (e.g., priced funding round).

Convertible notes have a maturity date. A maturity date is the date certain that the convertible note must be repaid. Convertible notes are structured similarly to a loan, with the exception that they typically automatically convert into shares of a stock upon a specified event, alleviating the need to repay the underlying cash amount.

Convertible notes help a company by providing a capital foundation prior to a company valuation and raising a priced funding round. Not only do these notes help startups focus solely on growing their business without having to pay debts immediately, but they are also a fast way to raise money, and convertible notes bypass the need to issue equity by using debt. There is also a benefit to investors. One such mutual benefit is that it does not force an investor or startup to determine the value of the company when there might not be much to do a valuation on.

In addition to the maturity date, important terms of a convertible note include the valuation cap, discount rate, and interest rate. An investor usually gets the benefit of the valuation cap or the discount rate or both, plus the interest rate at conversion. The valuation cap is a mechanism that caps the maximum company value at which a convertible note converts into equity.[2] On the other hand, the discount rate is a discount to the valuation the company receives in its priced financing round that allows an investor to purchase the equity securities at a price below that of paid by the equity investors. The discount rate offers downside protection in the event the valuation in the priced offering is lower than the valuation cap in the convertible note. Finally, similar to a traditional loan agreement, convertible notes accrue at a pre-determined interest rate that can be applied to the principal invested, which will then increase the number of shares issued to an investor at conversion.

Overall, convertible notes are a great option for startups that can benefit from seed funding and do not otherwise have access to equity or traditional debt funding. They are also simple in structure, of lower risk, all while being efficient. Financing with convertible notes is generally faster and less expensive in comparison to other measures that might require additional documentation which a startup may not necessarily have available right away.

Please contact us if you have any questions regarding why a convertible note may be the best tool for your upcoming fundraising efforts.

[1] https://www.shulmanrogers.com/news-events/what-is-a-safe-note/

[2] E.g., if the priced round has a valuation of $20,000,000 and the convertible note has a valuation cap of $10,000,000, the convertible note will convert at a valuation of $10,000,000.

NEXT powered by Shulman Rogers is our practice group for startups and emerging growth companies, offering over 70 fixed price packages covering a broad range of legal needs including: formation, financings, intellectual property, employment, compensation, and much more.

Working from Home During a Pandemic by Jessica Baker

The article below was published with permission from the Maryland Association for Justice.

What is a SAFE Note?

When early stage companies set out to raise initial capital they are often presented with multiple fundraising vehicles to accomplish their goal. While most entrepreneurs are familiar with Convertible Notes[1] and Priced Rounds[2], less may be familiar with SAFEs and the associated key terms. One frequent question NEXT[3] receives is: “What is a SAFE?” A SAFE is a Simple Agreement for Future Equity, and while SAFEs have been ubiquitous on the west coast since Y-Combinator’s[4] introduction of the SAFE in 2013, the SAFE has only recently gained widespread adoption by east coast investors.

Similar to a Convertible Note, a SAFE converts into equity upon a specified future event— that “specified future event” is typically a company’s Next Equity Financing[5]. However, unlike a Convertible Note, a SAFE is not considered debt, which means it does not have an interest rate and a set maturity (or expiration) date. This allows an early stage company the flexibility of raising capital via a convertible instrument, without the looming deadline of a specified repayment or maturity date. SAFE holders can best be described as early investors into a future Priced Round.

Inevitably, the next question will be: “What are the key terms of a SAFE?”

The two most important terms of a SAFE are the Valuation Cap[6] and the Discount[7]. Either the Valuation Cap or the Discount will be used to determine the price per share a SAFE converts at—in most cases—upon the happening of the Next Equity Financing. At the time of the Next Equity Financing, the company will calculate the conversion price per share of the SAFE using the Valuation Cap and the Discount. The calculation that produces the lowest price per share upon conversion will be utilized. More often than not, the SAFE’s Valuation Cap will be applied if a company continues to grow and rapidly increase in value. Nevertheless, the Discount provides downside protection to a SAFE investor in the event the valuation of the company’s Next Equity Financing is less (or marginally higher) than the Valuation Cap of the SAFE.

The Company—albeit with investor influence—must determine what percentage and amount to set the Discount and Valuation Cap at, respectively. The industry standard Discount continues to be twenty percent (20%), with upward or downward adjustment in exceptional cases. Although the Discount can be anchored to an industry standard with ease, the Valuation Cap cannot. A Valuation Cap is a forward looking, arbitrary amount set by the company based on numerous factors including, but not limited to, the (1) experience of the founding team, (2) market size and potential, (3) proof of product, and (4) previously completed financings, among others. On one hand, setting the Valuation Cap too low may cause a company to undervalue itself and sell too much, while on the other, setting the Valuation Cap too high may drive off investors. A good rule of thumb is to look to sell between fifteen and twenty-five percent (15-25%) of your company in each financing round.[8]

Admittedly, any stage of capital raising can be perplexing, and undoubtedly involves more considerations than any brief overview can provide, from setting a proper valuation cap to compliance with securities laws. As such, competent counsel should always be consulted before conducting a SAFE offering.

Please contact us if you have any questions regarding why a SAFE may be the right (or wrong) tool for your upcoming fundraising efforts.

By Hunter Haines, Associate NEXT powered by Shulman Rogers

[1] https://next.law/fundraising/convertible-note/

[2] https://carta.com/blog/convertibles-safes-priced-rounds/

[3] https://next.law/

[4] https://www.ycombinator.com/

[5] A “Next Equity Financing” can be defined as the next time the Company issues equity securities in a single transaction, or series of related transaction whereby a specified minimum amount of capital is raised.

[6] A “Valuation Cap” is the maximum valuation of the company at which the SAFE converts into capital stock at the time of the Next Equity Financing, regardless of the valuation agreed to by the company and the new equity investors.

[7] A “Discount” is a percentage reduction of the price per share in the Next Equity Financing.

[8] For example, if you are looking to raise $1,000,000, a pre-money Valuation Cap of $4,000,000 results in the sale of twenty percent (20%) of the company after the transaction is completed ($4,000,000 + $1,000,000 = $5,000,000. $1,000,000 / $5,000,000 = 0.2 or 20%).

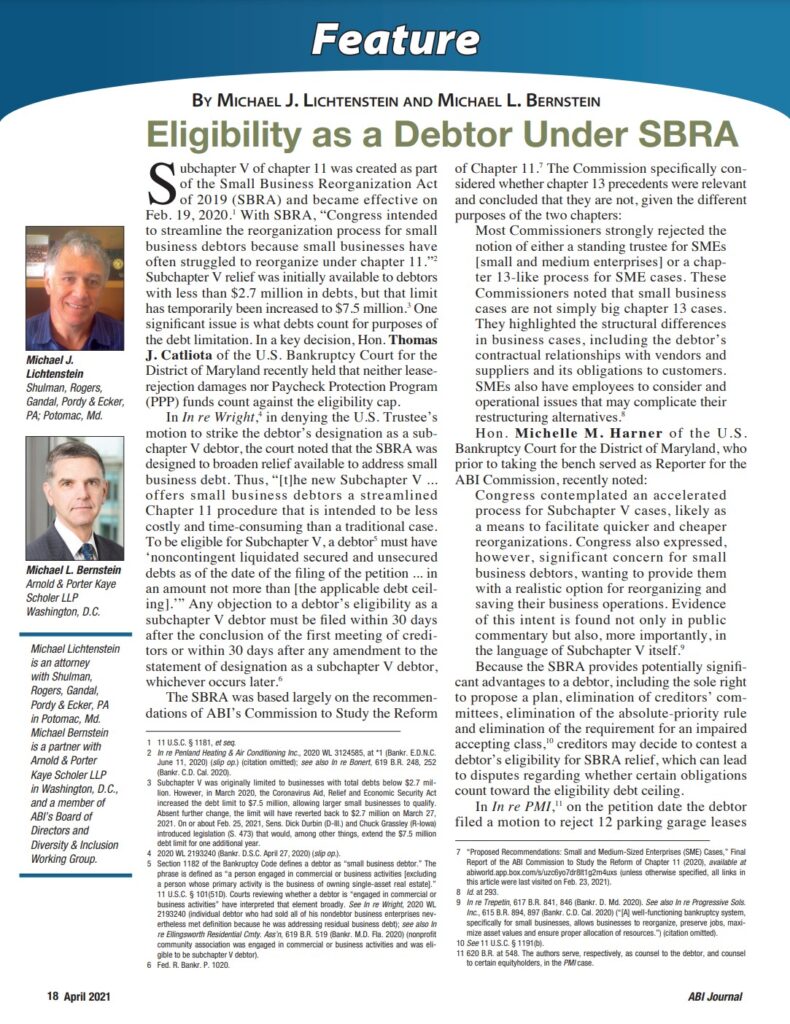

Michael Lichtenstein Co-Authors Article on Eligibility as a Debtor Under SBRA for American Bankruptcy Institute Journal

Shulman Rogers Bankruptcy, Restructuring and Creditors’ Rights attorney, Michael Lichtenstein was honored to be published in the American Bankruptcy Institute Journal. The article he co-authored with Michael Bernstein of Arnold & Porter Kaye Scholer appears below.

Custody, COVID-19, and Returning to School

“What are we going to do about school?”

Summer is more than halfway over and the same question is on many parents’ minds: “What are we going to do about school?” Recently, Montgomery County Public Schools (“MCPS”) announced that the school year will begin virtually, but MCPS will re-evaluate in November the possibility of returning to in-person classes at that time. Mayor Bowser of Washington, DC, is expected to make an announcement by July 31 regarding the reopening plan for DC public schools. Many private and parochial schools in the area have crafted a hybrid approach, with students alternating between virtual and in-person learning. With this fluidity comes uncertainty. Parents may find themselves in a position of having to choose whether to send their children back to school in-person during a pandemic or continue with online learning.

The past several months of the COVID-19 pandemic have taught us that state, county and local plans can change weekly. The upcoming fall school schedule is unlikely to look like the previous school schedule parents were familiar with prior to the beginning of the pandemic. Days may be shortened, virtual learning is likely to continue in some capacity, and bus routes may not run as they once did. Parents who were previously working from home while homeschooling may now be returning to the office.

The decision whether to send a child back to in-person learning is already a difficult one to make for parents whose relationship is intact. But what about parents who are divorced or separated? Many of these parents are already struggling during the pandemic to adhere to their regular access schedule currently in place. Parents who typically are in the boardroom wearing business attire are now making presentations sitting at the kitchen table, their babies napping just off screen. Breaks between meetings are spent fixing kids’ lunches and helping with arts and crafts projects. Even though we have come a long way adjusting to the “new normal,” making a decision whether to send a child back to a physical school building, when, and on what schedule, may not be one on which parents readily agree.

Such a decision can involve many legal considerations. If one parent already has sole legal custody, it may ultimately be his or her decision to make. If the parents have joint legal custody, it will be a decision that they must make together. In either scenario, if one parent adamantly disagrees with the other parent’s preference, they may need help from an attorney and/or other professionals to reach an agreement. The Maryland Governor’s Office of Legal Counsel clarified that the previously issued Stay-At-Home Order, while it was in effect, did not prohibit “parents from leaving their homes as necessary to facilitate visitation or exchange of custody.” If a parent believes that a change to the custody order in place is in his or her child’s best interest, but the other parent does not agree, the parent seeking a modification can ask the court to make a change. Filing for a modification of a custody order requires a showing that there has been a material change in circumstances and that a modification is in the best interest of the child.

The Divorce and Family Law attorneys at Shulman Rogers can guide you through this process, whether it be pursuing legal action or seeking to resolve the issue outside of court. Our team is well versed in the applicable custody laws and is closely monitoring the developing judicial interpretations of the same in the COVID-19 era. Contact us today to discuss how we can help you.

MORE INFORMATION

The contents of this Alert are for informational purposes only and do not constitute legal advice. If you have any questions about this Alert, please contact the Shulman Rogers attorney with whom you regularly work or a member of the Divorce and Family Law Group.

What’s Happening With M&A? — Buyers: Be Prepared!

In this second alert in our series discussing M&A in the COVID-19 era, we will address potential acquirers in the marketplace. As we posited in our last release, the COVID-19 pandemic will most certainly create opportunities for buyers poised to act fast to seize good deals when they arise. In fact, a number of our buy-side clients have already contacted us about potential acquisitions and other transactions in the coming months as founders of potential target companies struggle to sustain operations, notwithstanding their otherwise strong business models.

So how can you, as a potential acquirer, prepare to move quickly and decisively when an opportunity presents itself? First, you should prepare and upgrade your standard deal documents (e.g., preferred forms of a mutual nondisclosure agreement, due diligence request list, and letter of intent) so they’re ready for immediate delivery to a potential target. Having these documents ready and waiting will help you accelerate the negotiation process, understanding that deal-specific tweaks will need to be made to these documents before you send them to your prospective target.

Of course, the definitive purchase agreement is the document that really counts. There is no reason to draft that document before addressing certain key considerations (e.g., will the acquisition be completed via a purchase of assets or equity of the target, or as a merger); but buyers would be wise to anticipate and consider how to address certain key issues and negotiation points that the parties will have to tackle in order to seal the deal. For example:

- Purchase price: More now than in recent years, buyers and sellers are likely to have inconsistent views about the value of the seller’s business. Historical financials may support the seller’s view of valuation, while the recent and perhaps prospective impact of the COVID-19 downturn will color the buyer’s competing view. Buyers should be prepared to consider creative ways to bridge any gap with the seller on price, including by making a portion of the purchase price contingent on performance of the target business after closing (an “earnout”) or potentially paying a portion of the purchase price in equity of the buyer (which would enable the seller to participate in future value created after the acquisition).

- Working Capital Adjustment: The working capital adjustment in a transaction (e.., increasing or decreasing the purchase price based on how much working capital the target has at closing relative to an agreed-upon target) can often be the subject of significant negotiation prior to the deal closing and stinging disagreements after closing. Given the current downturn and its impact on cash flows, buyers will need to pay particular attention to how the working capital target is calculated as sellers seek to minimize the risk of failing to meet the target and the resulting purchase price reduction. While the seller will point to the business’s pre-downturn working capital needs to support a particular target for this purpose, the buyer will need to reassess working capital needs in light of financial strains on the business created by the pandemic. If nothing else, buyers should reevaluate what constitutes normalized working capital in the downturn and should also push for a longer post-closing purchase price adjustment period to allow more time to assess the pandemic’s impact on the target’s business. Buyers should also consider pushing for increased working capital escrow amounts to help minimize risk.

- Representations and Warranties: Every purchase agreement requires the seller to make representations and warranties about the business and operations of the business, and then stand behind those representations after closing if any of the representations or warranties are incorrect and buyer suffers a financial loss. Buyers should upgrade and expand the customary representations and warranties contained in their current form purchase agreements in order to ferret out operational, contractual, and financial challenges caused by the pandemic. For example, consider asking the seller to provide representations concerning (i) compliance with SBA regulations and the terms of any CARES Act loans the seller may have obtained, and (ii) the impact of those loans on the terms of any preexisting indebtedness. Consider also strengthening seller representations concerning accounts receivable and payable, deviations from GAAP in financial statement preparation, the absence of material changes since the last financial statement date, and the status of key customer and supply agreements.

- Pre-Closing Operating Covenants: For transactions where there will be an interim period between the signing of the purchase agreement and closing, buyers should anticipate and plan for how to address seller requests for increased latitude in operating the business prior to closing in light of the challenges of the current downturn, while still giving the buyer approval rights over certain significant actions by the target. Will the buyer want more rather than less oversight and consent rights over seller’s pre-closing operations in light of current conditions? If yes, and understanding that most sellers will resist buyer’s involvement in operations, consider what specific areas cause particular concern and be prepared to provide a principled argument for greater-than-normal buyer oversight. Examples of potentially sensitive areas include expansion of sick-leave policies, changes in supply arrangements, amendments to material contracts, and operational shutdowns.

- Closing Conditions: Given the unpredictable impact of the COVID-19 crisis on the economy and your seller’s business, buyers should revisit the closing conditions section of the purchase agreement and reconsider what circumstances, if they arrive, should give the buyer the right to walk away from the deal and terminate the transaction. For example, if an unforeseen government shutdown order prevents the seller from operating in the ordinary course, should the buyer have the ability to terminate the deal, or just postpone closing? In this regard, give some thought to the proposed “drop dead date” (or “end date”) and consider if providing for a longer than normal runway to closing might make sense in light of broader market uncertainty and other factors like slower regulatory review. Consider also including a financing out to give the buyer the right to walk away from the deal if bank financing does not materialize because of downturns in the credit market.

- Insurance: Given the increased affordability of representation and warranty insurance, buyers should explore whether they can obtain insurance for their deal at an attractive price, and ask the seller to share in the cost of the policy (e.g., cost of the premium or any deductible that the buyer must meet before recovering under the policy). If the buyer does purchase coverage, they will need to review the policy carefully and potentially negotiate with the insurer to minimize coverage exclusions for COVID-19 or to tailor them as narrowly as possible.

Be on the lookout for our next alert where we’ll address what sellers can and should do to be prepared for a transaction in this pandemic-induced downturn. Until then, be safe and take care.

By: Aaron A. Ghais and Keith A. Marshall

MORE INFORMATION

The contents of this Alert are for informational purposes only and do not constitute legal advice. If you have any questions about this Alert, please contact the Shulman Rogers attorney with whom you regularly work or feel free to contact a member of the Mergers and Acquisitions Team.

What’s Happening With M&A — How Can You Get Ready?

Greetings from the M&A team here at Shulman Rogers! First and foremost, we hope that you, your family and your team remain healthy and safe during these difficult times.

Status Check

We are now more than a month into the U.S. COVID-19 shutdown and several months into the broader global crisis. The impact on U.S. and global M&A activity has been both sudden and severe. Global M&A for Q1 2020 is down 33% as compared to Q1 2019; and the value of announced mergers in the U.S. is down more than 50%. Among the many factors exacerbating this already difficult situation are the increasing scarcity of debt financing for new acquisitions as banks are preoccupied with SBA lending and other urgent client needs, as well as the challenges that buyers and sellers have in fixing and agreeing upon valuations as many industries contract due to the global downturn.

Not surprisingly, most parties that were considering M&A transactions before the onset of the pandemic have either put those transactions on hold or abandoned them. Nevertheless, some deals are moving forward, including deals where the target or its industry are insulated from the effects of COVID-19, and where the target’s business has increased as a result of the pandemic.

For the companies delaying or abandoning deals, their focus has rightly shifted to shoring up their businesses as they prepare for a longer downturn. We have assisted many of our business clients in addressing the immediate challenges facing their businesses as they navigate these turbulent times. Perhaps most critical, we’ve helped them obtain financial relief through millions of dollars of SBA-backed Payroll Protection Program loans and state and local loan programs.

What About M&A?

While we don’t have a crystal ball to tell us how long this crisis will last and when M&A activity will spring back to life, if there’s anything that we’ve learned from prior downturns, it’s that bad times don’t last forever. Every downturn creates opportunities for growth and progress. Those opportunities are not always obvious, and they often come and go quickly. But they will be there for those ready to seize them, and readiness will be key.

How Can You Get Ready to Seize an Opportunity?

Maybe a company you were looking to buy can be acquired now or in the near future for a much more attractive price. On the sell-side, maybe your company suddenly is in a hot industry – think personal protective equipment, cleaning supplies or online social networking – and you have the ability to sell now at a significantly higher price than you could have fetched pre-pandemic. Again, some deals actually are moving forward now and getting done, and maybe yours could too.

Bottom line: parties who are ready and able to move quickly will be best able to capitalize on the opportunities arising during and after this pandemic—which begs the question, “Are you ready to move quickly?”

For sellers, “being ready” means:

- retaining and incentivizing your management teams;

- doing everything you can to preserve revenue;

- being prepared to prove to buyers that your business retains significant value and continued viability;

- working with your legal counsel and investment banker to assemble a data room and identify interested buyers;

- assessing go-to-market strategies; and

- refreshing your valuation analysis.

For buyers, “being ready” means:

- preparing to move quickly on a deal;

- hunting for companies that can round out your capabilities or help you fulfill an unmet need in the marketplace;

- considering creative alternatives to structuring acquisitions (including staged purchases and the use of earnouts and other contingent payment arrangements);

- fine-tuning your diligence review processes to focus on how the pandemic has impacted target companies’ financial health and operations (including the pandemic’s impact on contracts with customers and suppliers, and the availability of insurance coverage that could soften that impact); and

- drafting standard deal documents (e.g., preferred forms of nondisclosure agreement, due diligence request list, and letter of intent) and adding new and improved provisions to your acquisition agreements to address particular issues and risks created by the pandemic (with particular focus on pre-closing operating covenants, closing conditions, and material adverse change provisions).

In the meantime, we encourage you to visit our COVID-19 Resource Center, where you will find articles, legal alerts and webinar recordings addressing a wide range of topics, including SBA-backed loan programs, human resources and employment issues and insurance matters – you’ll find them to be both useful and practical.

And, be on the lookout for additional releases from the Shulman Rogers M&A team in the coming weeks as we continue to monitor developments relating to the COVID-19 pandemic and its impact on the M&A world. Until then, be safe and take good care.

By: Aaron A. Ghais and Keith A. Marshall

MORE INFORMATION

The contents of this Alert are for informational purposes only and do not constitute legal advice. If you have any questions about this Alert, please contact the Shulman Rogers attorney with whom you regularly work or feel free to contact a member of the Mergers and Acquisitions Team.

Residential Foreclosures (DC)

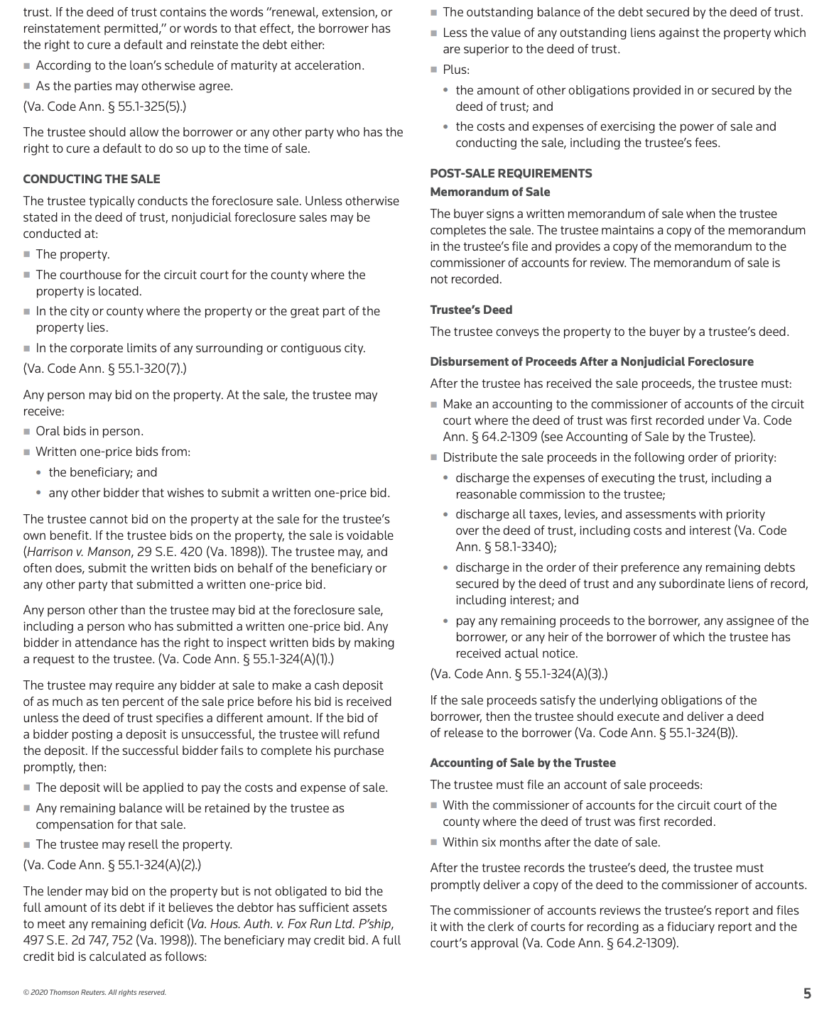

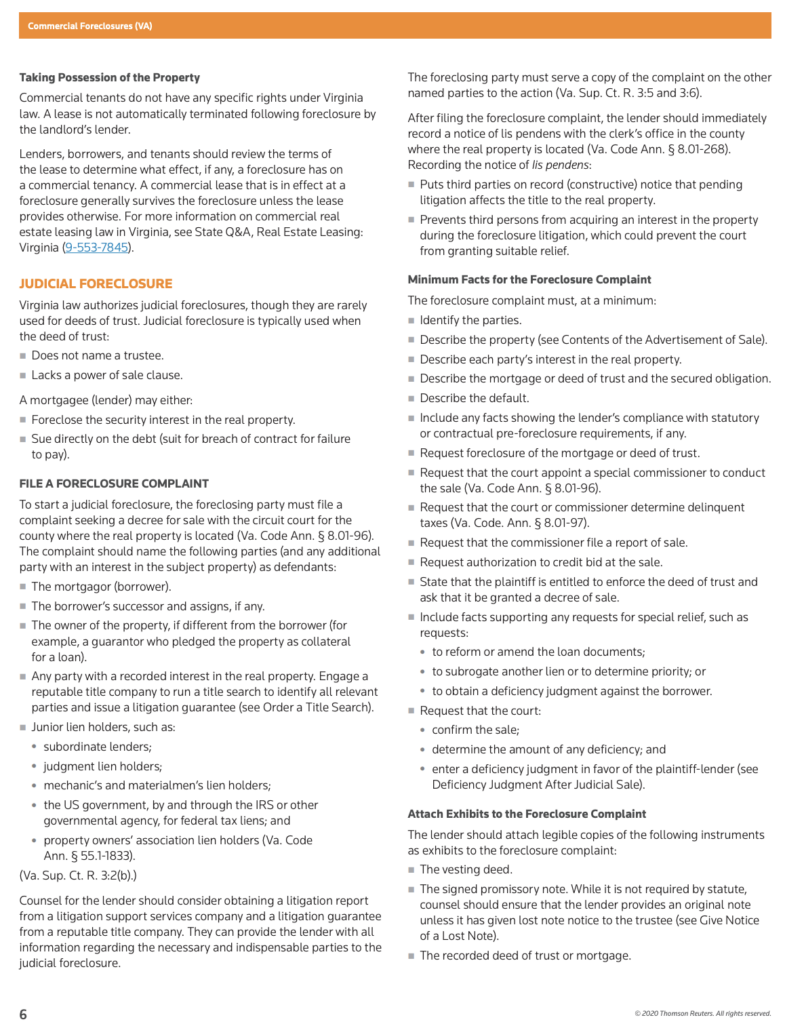

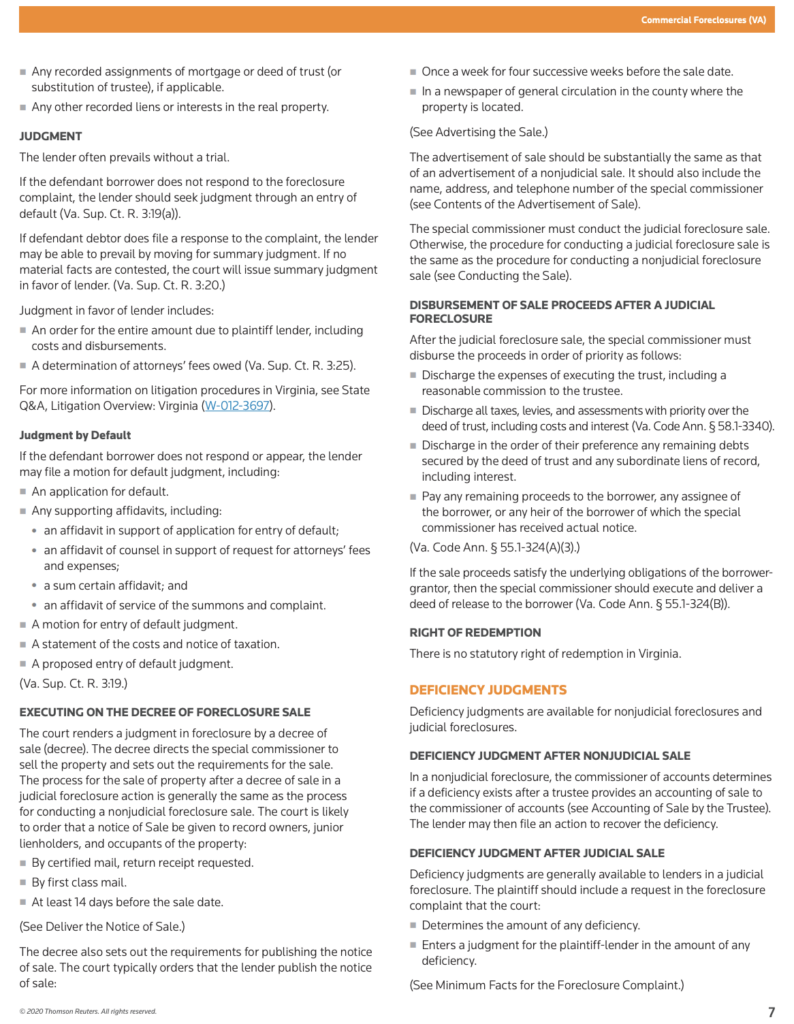

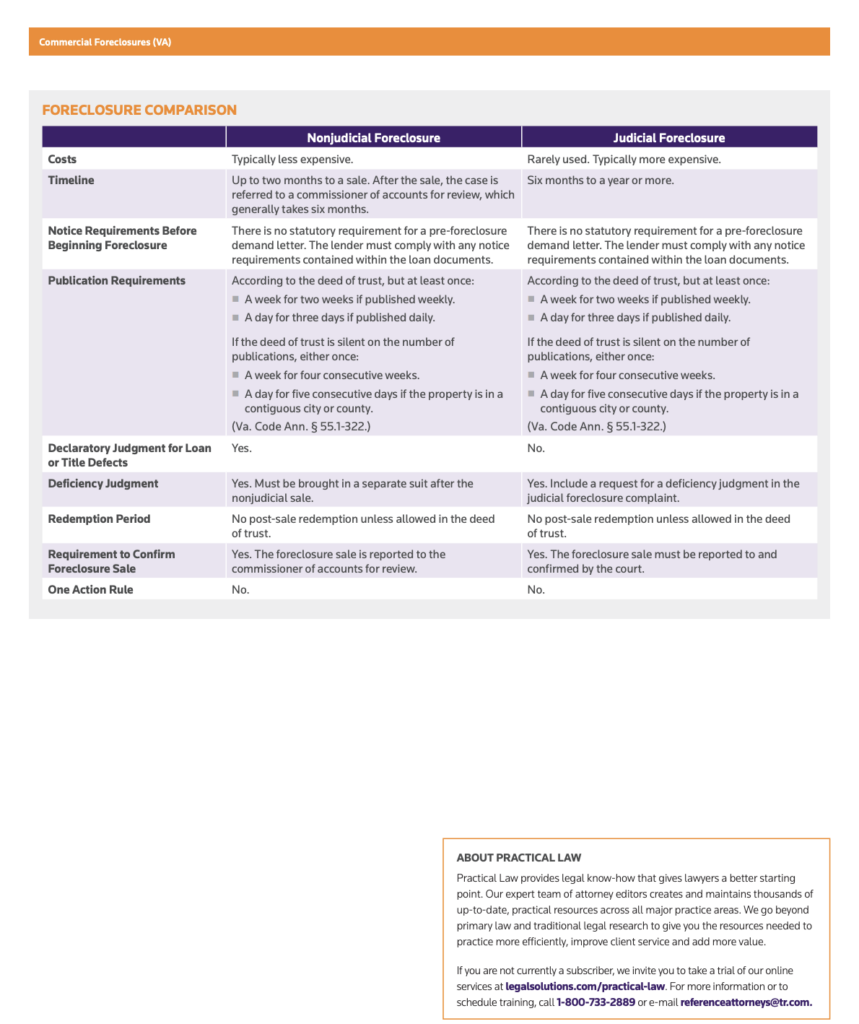

Commercial Foreclosures (VA)