- Only banks, credit unions, and similar entities are permitted to obtain a security interest in a Maryland cannabis license.

- All security interests in Maryland cannabis licenses must be approved by the Maryland Cannabis Administration.

- Several questions remain unanswered in the Emergency Regulations, including whether an eligible secured creditor can take a security interest in a license as a collateral agent for itself and other lenders (some of which may not be eligible secured creditors).

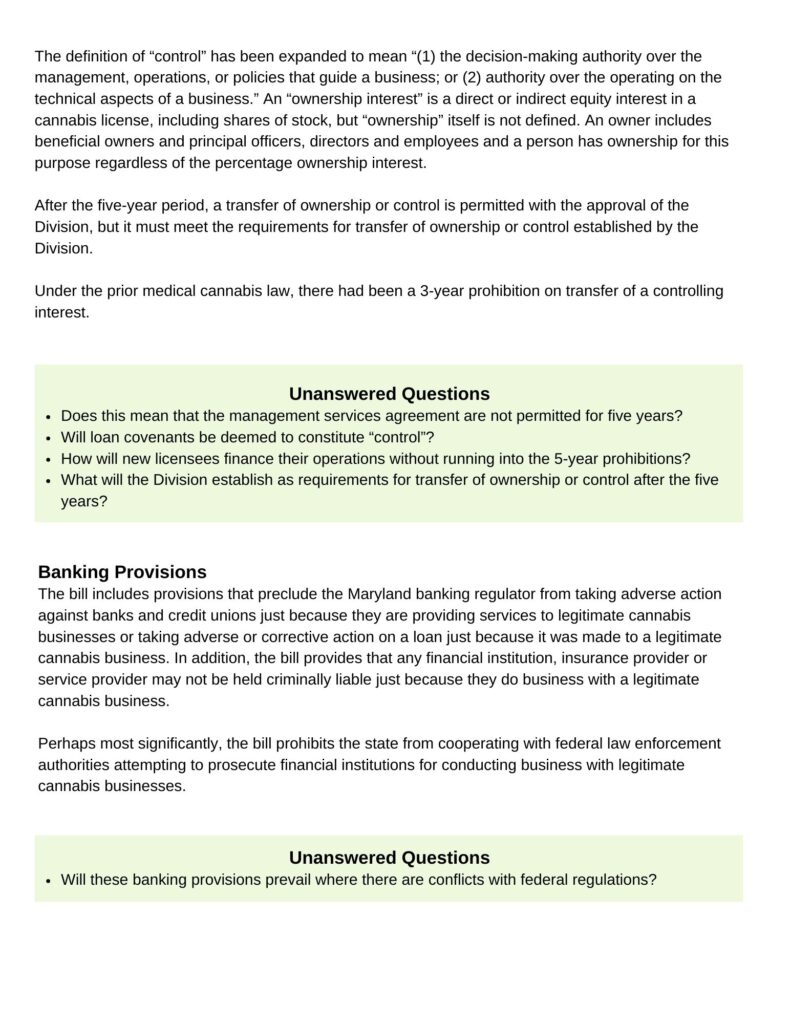

Like most companies, Maryland-licensed cannabis businesses generally rely on access to capital to purchase equipment and other capital assets, fund acquisitions and other forms of expansion, and provide working capital to cover short-term expenses. Industry experts agree that venture capital is extremely difficult to obtain in the cannabis space and that most equity raises are limited to friends and family rounds. In addition, because the production, distribution, and sale of cannabis and products containing cannabis remain in violation of federal cannabis laws, cannabis businesses are unable to obtain loans from any financial institution that is regulated by a federal agency (which includes the vast majority of banks operating in Maryland).

As a result, Maryland-licensed cannabis business have had only two choices for obtaining debt capital – either one of the few state-regulated financial institutions willing to lend to cannabis companies, or a non-bank lender that is not regulated. In either case, as is typical of secured transactions, the lender would expect to obtain a security interest in all of the assets of the borrower, including any cannabis license. Once a lender or other secured party obtains a security interest in assets of a borrower and takes certain steps such as filing a notice called a financing statement (referred to as a UCC-1 in the Uniform Commercial Code), the secured party expects to be able to foreclose on the assets of the borrower if the borrower does not repay the loan by its terms – this foreclosure typically is an out-of-court sale of the pledged assets to the highest bidder, with the proceeds of the sale used to repay (in order) the costs of sale, the debt owed to the secured party, and any additional sale proceeds paid the borrower.

But one unresolved question was whether the security interest in a Maryland-issued cannabis license was enforceable. In other words, it has never been clear whether a secured party ever obtains any rights in a cannabis license – arguably one of the most valuable assets of a cannabis company. If not, then a foreclosure sale following default of a loan to a cannabis company would be much less likely to generate proceeds in an amount to repay the defaulted loan in full.

Adult Use in Maryland and Recent Emergency Regulations

Following approval by Maryland voters of adult-use cannabis legalization as part of a November 2022 ballot referendum, the Maryland legislature passed the Cannabis Reform Act which was signed into law by Governor Moore in May of 2023. On June 23, 2023, the Joint Committee on Administrative, Executive, and Legislative Review approved Emergency Regulations, found at COMAR 14.17.01 – 14.17.22, which took effect on July 1, 2023.

These new regulations cover many topics related to the expansion of cannabis into adult use, including: conversion of existing medical licenses into adult use licenses; the process for issuance of new licenses (including new license categories); testing laboratory registration and operations; operational issues for growers, processors, and dispensaries; record keeping, inspections, and enforcement issues; ownership and control; and related issues. Enforcement will be supervised by the Maryland Cannabis Administration (the “Administration”), as a successor to the Maryland Cannabis Commission.

This alert focuses on the subset of the new Emergency Regulations that relate to the ability of a lender to obtain a security interest in a cannabis license.

Security Interest in a Maryland Cannabis License

Which Lenders Can Obtain

The Emergency Regulations provide that a licensed grower, processor, or dispensary may pledge to an eligible secured creditor an interest in the proceeds from an Administration-approved sale of cannabis license as a security interest for a loan. But there are numerous requirements and restrictions baked into this simple statement.

The secured party must be a “secured creditor” – under the Emergency Regulations this means a lending institution as defined under the Maryland Financial Institutions Code, whether chartered by Maryland or any other state. Such institutions include commercial banks, non-depositary trust companies, savings banks, credit unions, and savings and loan associations. Note that this definition would exclude any of the non-bank lenders that typically are funds using private capital to make loans (sometimes in addition to private equity investments).

Approval to Act as Secured Creditor

To act as a secured creditor the lending institution must submit to the Administration for approval (i) a compliance and reporting plan; (ii) a proposed plan for the appointment of a receiver that meets the requirements set forth in the emergency Regulations; (iii) confirmation that the lending institution is in good standing and eligible to conduct business in Maryland and is in compliance with any regulatory requirements applicable to the lending institution; and (iv) any other information requested by the Administration. The secured creditor also will need to submit an annual report to the Administration certifying continued compliance and eligibility. The Administration will maintain on its web site a list of approved secured creditors.

Approval of Security Interest

To obtain approval for a security interest in connection with a specific transaction, the approved secured creditor must submit to the Administration for approval a copy of the security agreement intended to be used. An approved security agreement may not contain provisions that authorize the secured creditor to unilaterally: (i) require the loan to become due, except if the licensee materially breaches or defaults on its material obligations as set forth in the security agreement; (ii) convert the debt under the loan to equity; (iii) deprive the licensed grower, processor, or dispensary of the right to operate the license; or (iv) restrict the ability of the licensed grower, processor, or dispensary from making payment on the secured loan through a third party unless the payment restriction would cause the secured creditor to violate a law by which it is governed. The Administration also may restrict a security interest for “other good cause” as determined by the Administration.

The scope of the security interest, once approved, is limited to the proceeds of a sale of the license that occurs in accordance with a disposition plan as required by the Emergency Regulations. The security interest excludes any right to operate the license.

Plan of Disposition

The Emergency Regulations include detailed provisions addressing the plan for the disposition of a cannabis license, including: (i) selection of an eligible receiver; (ii) application for receivership; (iii) security protocols for the receiver in non-public areas of licensed premises; (iv) the receiver’s responsibilities; and (v) sale of the cannabis license.

Although foreclosure sales of personal property collateral under the Uniform Commercial Code can proceed rather quickly, often in as few as 10 days following a required notice of sale, the timeline for the disposition of a license under the Emergency Regulations will be considerably more time consuming. The starting point will be that either (i) the lender has obtained a receivership order from a court, (ii) the borrower is insolvent, or (iii) the borrower has materially breached its obligations under the Administration-approved security agreement. Following one of these triggering events, the Administration must approve the appointment of the receiver following submission of an application with detailed information about the proposed receiver as well as a plan of disposition. Any proposed sale requires advance notice of at least 60 days, and potential bidders must be approved by the Administration. Any completed disposition and transfer of a license will not be final until approved by the Administration.

Summary

While the Emergency Regulations have clarified some important issues with respect to secured lending to Maryland-licensed cannabis companies, the new restrictions may have the unintended result, at least in the short term, of limiting the ability of Maryland licenses to obtain much-needed debt capital. Potential lenders that cannot qualify as eligible “secured creditors” under the Emergency Regulations may not want to lend the Maryland licensees now that it is clear that such non-bank lenders will not be able to obtain a security interest in cannabis licenses. And lenders that could be eligible to obtain a security interest in a cannabis license, such as state-chartered banks, will have to jump through many time-consuming hoops to obtain Administration approval.

Unanswered Questions

- Do the regulations limit the ability of a lender that is not a “secured creditor” (as defined in the Emergency Regulations) from making a loan to a Maryland-licensed cannabis company and taking a security interest in assets other than the license(s)?

- Can an eligible secured creditor take a security interest in a license as a collateral agent for itself and other lenders (some of which may not be eligible secured creditors)?

- What is an example of “other good cause” that would permit the Administration to restrict the security interest in favor of an eligible secured creditor?

- The scope of the approved security interest is limited to the proceeds of an Administration-approved sale of a licensed grower, processor, or dispensary – but does this provision refer only to a sale by a receiver established at the request of the secured party, or will the scope of the security interest include any sale of a license, even without use of the receiver or consent of the secured party?

Please contact us if you have any questions regarding your cannabis business or how the Act may affect the operation of your business.

To read the full text of the Emergency Regulations, click HERE.

CONTACT

MORE INFORMATION

The contents of this Alert are for informational purposes only and do not constitute legal advice. If you have any questions about this Alert, please contact the Shulman Rogers attorney with whom you regularly work or a member of the Shulman Rogers Cannabis Industry Group.