Whether they are buying, selling or financing businesses, CEOs, business owners, and investors turn to Aaron Ghais to get deals done. Aaron specializes in representing mid-market companies that aspire to grow through acquisitions, and also helps business owners maximize value when they sell their companies. Clients benefit from his ability to lead them successfully through the M&A process using his creative problem-solving skills, well-honed business sense, and results-oriented style.

A former “Am-Law 10” lawyer, Aaron leads the Shulman Rogers M&A Practice Group and serves as Co-Chair of the Firm’s Business and Financial Services Department. He leverages the knowledge gained through over 25 years of successfully completing complex transactions to accomplish his clients’ objectives and overcome their legal and business challenges. (Please scroll down to see testimonials from some of Aaron’s clients.)

Aaron has a national practice representing corporate, venture capital and private equity clients in connection with a variety of transactional and securities matters. These include mergers, acquisitions, dispositions, exchanges and joint ventures, as well as venture capital financings, securities offerings, debt financings, recapitalizations and other strategic transactions.

He has been involved in all phases of the transaction process, including structuring, negotiation, implementation, and ongoing post-transaction advice.

Regularly providing advice on corporate, securities and other business-related matters, Aaron serves as outside general counsel to a number of his clients; assists entrepreneurs and startup companies in connection with their formation and financing; advises boards of directors on various aspects of corporate governance, and represents funds that invest in emerging growth companies.

A respected leader in his field, Aaron is frequently recognized in publications like the Best Lawyers in America®.. He is a regular speaker on M&A-related topics and current developments in the deal markets and serves as a member of both the ABA’s Section of Business Law and Mergers and Acquisitions Committee. He previously served on the ABA Subcommittee on M&A Market Trends and the ABA Subcommittee on Public Company Acquisitions. Aaron also serves on Shulman Rogers’ Board of Directors and Executive Committee.

Testimonials

“We went into a sizeable M&A transaction knowing a whole lotta nothin’. Well, that’s not entirely true – we knew the legal work and negotiations were going to be complicated, labor-intensive, and stressful at times. The deal was all of those, but we realized quickly that we were in good hands with Aaron Ghais, and others on the M&A team at Shulman Rogers. They knew their way around the issues and provided advice that reflected judgment honed over many years of deal-making. We appreciated their responsiveness and collaborative approach. We always felt that we were their most important client, and we highly recommend the Shulman Rogers team to anyone looking for stellar M&A counsel.”

–Stephen Kaye and Adam Deem

Teak Tree Capital

“I couldn’t have been more pleased with the savvy advice and results-driven leadership that Shulman Rogers provided in a critical two-pronged deal for us. Aaron Ghais and Keith Marshall brought strong judgment, creativity, and a collaborative approach to spearhead the completion of an industry-changing acquisition. I’d happily refer this team to anyone who asked!”

–Sean Cercone, CEO/President

Broadway Licensing

“Our sale transaction became unexpectedly complex and prolonged because of a handful of challenges that arose during the course of negotiations. Aaron Ghais and his M&A team at Shulman Rogers did a truly superb job at navigating us through the multi-dimensional and interrelated issues across a number of areas including government contracting regulation, tax law, and PPP loan repayment rules. They more than held their own in negotiating against a much larger team of lawyers representing our buyer, and excelled at distilling and clarifying complexity so that we could make sound business decisions in the course of bringing the deal to a successful close.”

— client name withheld for confidentiality

“Aaron and his colleagues did an impressive job getting a very complicated deal done for us under challenging circumstances. I really respect the job that he and his Shulman Rogers team did for us. I will be referring future work to Shulman Rogers for sure!”

— Sam Corbitt, CFO

Siege Technologies, LLC

“I have been a client of Aaron’s for nearly three years. In that time, I have found him to be thoughtful, supportive, level-headed and, when necessary, forceful and persuasive. I’ve valued Aaron’s integrity and guidance on a wide number of issues and challenges. He has been very good at keeping me focused on the end goal, even when it seemed at times to be very far away. In a recent sell-side transaction, he was quite adept at sorting out complicated issues, negotiating favorable terms, and driving the transaction to a successful closing. He continues to provide ongoing legal counsel and, in doing so, continually adds value.”

— Elliot Rosen, Co-founder

BayFirst Solutions

“Aaron and his team displayed exceptional professionalism, dedication and hard work to help me close a sale transaction in record time. The timing was unusual and borderline unrealistic! The fact that Aaron and his team found a way to stay on top of the process is greatly appreciated and speaks volumes to his commitment to excellence! I am sure that I’m not Aaron’s only client, but everything that he’s done to-date makes me feel like I am his only client. His focus and commitment allowed us to get my company sold the right way and on time. I am grateful for that! That is a class-act!”

— Sam Saab, Founder and CEO

Results Software

“I have worked with Aaron Ghais professionally for about seven years. The breadth of work covered within that short span could encompass of a lifetime. I have utilized Aaron for business formation, buy-sell agreements, employment law and litigation, as well as complex business planning. The best way to describe Aaron’s greatest asset would be to say he is the most interested person I know both professionally and personally. That’s not a typo. When called upon, you get his full undivided attention as if you are his only client. Additionally, he advises you based on your best interests which may not be the advice you want to hear necessarily but ultimately is the most prudent, cost-effective approach. His mix of business knowledge and law have proven to be indispensable, as both need to be considered equally when advancing down a path. Additionally, while Aaron’s legal knowledge runs deep, he won’t pretend and provide a weak, uninformed opinion. However, he will find the answer to your question which is why I call upon him as my first stop on all legal issues.”

— Jeffrey S. Grinspoon, Co-Founder and Managing Director

VWG Group

“Aaron has been my trusted legal advisor since I launched my startup. We’ve experienced fantastic growth and success, but have also faced our fair share of challenges. Aaron has been there with me and for me, every step of the way, consistently providing thoughtful and timely legal and business advice. He’s pragmatic and practical, meaning he identifies what issues are important for my business and focuses on those issues without getting bogged down on arcane legal points that are not applicable to my business. On top of all that, he’s introduced me into his network and helped me grow my business. Aaron is exactly the kind of legal advisor every business owner wants and needs.”

— Thomas Prokop, Founder and CEO

Dinocrates Group, LLC

Professional & Community Affiliations

- ABA Section of Business Law, Mergers and Acquisitions Committee, Member

- Association for Enterprise Growth (AEG), Member

- Association for Corporate Growth (ACG), Member

- Maryland Tech Council, Member

- Moxie Award Program, Sponsor

Results

Private Equity and Venture Capital

- Represented a prominent private equity firm in the acquisition of television broadcast stations from a well-known broadcast company for approximately $125 million; and assisted in the formation and funding of the acquisition vehicle.

- Represented another prominent private equity firm in the acquisition of a German software company for approximately $130 million, and assisted in the formation and funding of the acquisition vehicle.

- Represented a Maryland-based venture capital fund in numerous preferred stock investments in middle-market and early-stage companies.

Financial Services

- Represented financial advisory firms in over 24 sale and restructuring transactions.

- Represented financial advisory firm in the acquisition, and later the sale, of an employee benefits practice.

Aerospace & Government Contractors

- Represented the stockholders and second-generation management team of a naval weapons company in a sale to L3 Technologies.

- Represented a marine technology company in a sale by merger to Danaher.

- Represented the founders of a major software reseller in a sale to a private equity-backed rollup acquirer.

- Represented an aerospace company and a special board committee in a merger with another aerospace company, with a transaction value of approximately $75 million.

- Represented stockholders of a successful cryptographic security company in the sale of their stock to one of the largest U.S. government contractors.

- Represented a major U.S. aerospace company in the sale of an unincorporated division to one of the largest Brazilian aircraft manufacturers.

Technology and Biotechnology

- Represented Singapore-based acquisition vehicle in the rollup of tech-based management services and financial technology companies.

- Represented a publicly-traded biotech company in the acquisition of a distressed competitor.

- Represented an innovative biotech company in a series of preferred financing rounds and acquisitions.

- Represented a prominent biotech company in a $325 million sale to a public company.

- Represented a healthcare technology company in a $150 million sale by merger to Press Ganey.

- Represented a healthcare technology company in a sale by merger to Centene.

- Represented, as outside general counsel, a number of middle-market and early-stage technology companies throughout the mid-Atlantic region and nationwide; and assisted many of those companies with private placement transactions.

- Represented a number of technology companies in the negotiation and creation of joint ventures.

Media & Entertainment

- Represented a prominent media company in the acquisition of assets from the then largest Canadian newspaper company for $235 million.

- Represented two cable companies in the sale of their assets to two national cable company owners, for $530 million and $175 million, respectively.

- Represented a leading licensor and publisher of play scripts for major Broadway plays in the acquisition of a competitor.

Energy

- Represented an oil distribution company in a private equity financing and, subsequently, in the acquisition of nearly a dozen competing companies for purchase prices ranging from $5-100 million.

Hospitality & Food Services

- Represented a restaurant and hospitality company in the acquisition of a well-known restaurant chain.

- Represented a major national hotel chain in the sale of non-core assets.

- Represented a leading wholesale produce seller in sale to Coastal Sunbelt Produce.

Real Estate

- Represented a Wall Street investment fund in a tender offer for shares of a public real estate investment trust.

- Represented a number of real estate companies in the negotiation and creation of joint ventures.

- Represented prominent commercial real estate brokerage to Colliers International.

Recognition

- The Best Lawyers in America, 2023-2025

- The Daily Record, Business Law Power List, 2024

Publications

- Client Alert: “What’s Happening with M&A and How Can You Get Ready?”

- Client Alert: “What’s Happening with M&A? – Buyers: Be Prepared!”

- “Two Deal Terms Buyers Should Avoid Like the Plague”

- “Starting the Acquisition Process: A Handful of Quick but Critical Tips”

- “When to Consider Using Acquisitions as a Growth Strategy”

- “Lessons Learned: Buying a Financially Troubled Company”

- “Understanding How Buyers Think – Key Insights That Can Help You Sell Your Business For the Best Possible Terms”

- “Three Key Limits to a Buyer’s Right to Recover When the Seller Breaches the Purchase Agreement”

- “State Treatment of LLC Interests as Securities”, Journal of Limited Liability Companies

Seminars & Speaking Engagements

- Webinar: “How To Prepare For M&A During The COVID-19 Recovery”

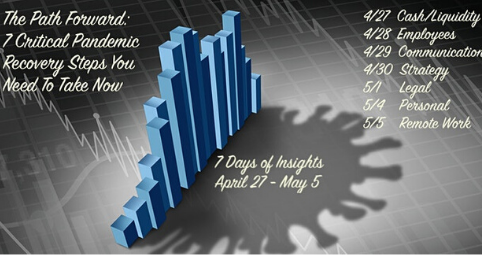

- Webinar: “7 Days of Insights – A Series of Briefings Presented by Association for Enterprise Growth: M&A and Recovery” (Association for Enterprise Growth)

- “Buy-Side Ready” (Exit Planning Institute)

- “Getting Ready to Sell Your Business” (Exit Planning Institute)

- “Reps & Warranties: Trends, Insurance, and Issue Mitigation” (Exit Planning Institute)

- “Ins and Outs of Succession Planning” (Exit Planning Institute)

- “Understanding How Buyers Think: Insights that can help you close more deals and make more money” (Exit Planning Exchange)

- “Aligning Shareholder Intent” (Exit Planning Institute)

- “How to Raise Money Without Giving Your Business Away” (The Power Conference)

- “How to Sell Your Government Contracting Business for Top Dollar”

- “Top 10 Legal Issues for Small Businesses”

News & Events