As the spring housing market explodes with the excitement of hopeful sellers, it is important to recognize some of the potentially unpleasant – but avoidable – surprises that may come up in the settlement process.

BAD NEWS: Unfortunately, most sellers don’t realize that they may be subject to state and federal income tax withholding until they arrive at the settlement table and it’s too late to prepare.

GOOD NEWS: If withholding is required, sellers may be able to reduce or eliminate the withholding requirement by filing for an exemption certificate.

In Maryland, if a seller is not a “Maryland resident,” the settlement agent or title company must withhold 7.5 percent of the “net” sales proceeds or 8.25 percent from a nonresident entity or company. They then remit that amount to the Clerk of the Court when the deed is submitted for recording.

To avoid the withholding requirement, a seller must certify under penalties of perjury that they are a Maryland resident, or if they are not a Maryland resident, that the property being sold was their principal residence. To qualify as a principal residence, the property must be registered as the seller’s principal residence with the State Department of Assessments and Taxation (SDAT) AND meet the Federal definition of “principal residence” as set forth in the Internal Revenue Code (IRC). In short, the seller must have occupied the property as his or her principal residence for an aggregate of two of the past five years. A common scenario involves a seller who meets the IRC definition of principal residence but recently moved to another state, causing a change in the property’s status with SDAT. If a seller has moved to another state and the property’s status with SDAT has changed from “principal residence” to “rental or investment status” (which SDAT may change automatically if the seller requested a new out-of-state mailing address for tax bills), then withholding will be required. If Maryland withholding is required, the seller may apply for an exemption certificate by submitting Maryland Form MW506AE to the Maryland Comptroller at least 21 days before closing.

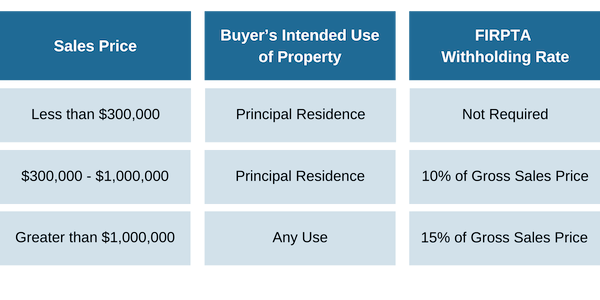

Similarly, the Foreign Investment in Real Property Tax Act (FIRPTA) requires a person who buys real property from a foreign person to withhold a portion of the seller’s proceeds at settlement and to remit those funds to the IRS. Unlike Maryland withholding, which calculates the withholding amount on the “net” sales proceeds, FIRPTA withholding is calculated on the gross sales price. The withholding rate depends on the sales price and the buyer’s intended use of the property.

If FIRPTA withholding is required, the seller may apply for an exemption certificate by submitting IRS Form 8288-B to the IRS before settlement.

With both of these exemptions, critical deadlines must be met in order to qualify. If you believe withholding applies to the sale of your property, please do not hesitate to reach out to our office for additional information.

Shulman Rogers Personal Services Group

Residential Real Estate | settlements@shulmanrogers.com

The contents of this email are for informational purposes only, and do not constitute legal advice. If you have any questions, please contact us.

Stay up to date with all the latest news and events.