D.C. Council Preserves Tip Credit

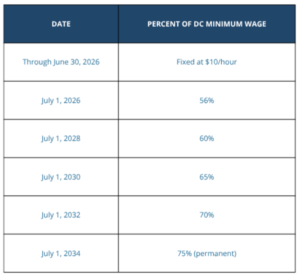

On July 28, 2025, the D.C. Council voted to scale back Initiative 82, a voter-approved measure that would have eliminated the tip credit by 2027, so that tipped workers earned the full minimum wage, currently $17.95 an hour. The Council’s new legislation implements a nine-year phase-in schedule culminating in 2034, when the tipped minimum wage will reach 75% of D.C’s regular minimum wage. A schedule of the revised tip schedule appears below.

Key Provisions:

What This Means for Employers:

Revised Tipped‑Wage Schedule:

Shulman Rogers’ Employment and Labor Law Group is ready to assist clients in navigating these changes and ensuring compliance with D.C.’s wage laws. We also invite you to subscribe to our newsletter to stay informed on the latest laws impacting employers by clicking HERE to subscribe.

Stay up to date with all the latest news and events.